Mortgage Broker Salary - The Facts

Wiki Article

How Mortgage Broker Vs Loan Officer can Save You Time, Stress, and Money.

Table of ContentsSee This Report about Broker Mortgage Near MeMortgage Broker Average Salary Fundamentals ExplainedThe smart Trick of Mortgage Broker Assistant Job Description That Nobody is Talking AboutWhat Does Broker Mortgage Near Me Do?A Biased View of Broker Mortgage RatesBroker Mortgage Rates Things To Know Before You Get This

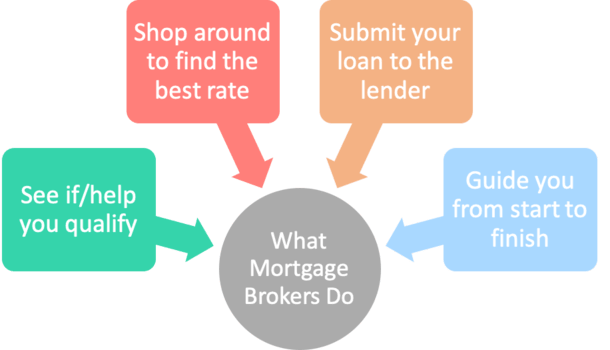

The mortgage broker's job is to understand what you're trying to achieve, function out whether you are all set to leap in now and then match a lending institution to that. Prior to speaking regarding lending institutions, they need to gather all the info from you that a bank will require.

A significant adjustment to the sector happening this year is that Home loan Brokers will have to adhere to "Ideal Rate of interests Duty" which implies that legally they have to place the client initially. Remarkably, the banks do not need to conform with this brand-new policy which will certainly benefit those customers making use of a Mortgage Broker a lot more.

Mortgage Broker Vs Loan Officer - Truths

It's a mortgage broker's task to help get you prepared. It might be that your financial savings aren't fairly yet where they ought to be, or it might be that your earnings is a little bit suspicious or you've been freelance and the banks need more time to evaluate your circumstance. If you're not yet prepared, a home loan broker exists to furnish you with the understanding as well as recommendations on how to improve your setting for a loan.

The home is yours. Created in partnership with Madeleine Mc, Donald - Mortgage broker.

The Only Guide to Broker Mortgage Fees

They do this by contrasting home mortgage products offered by a range of lenders. A home mortgage broker works as the quarterback for your funding, passing the sphere between you, the customer, and the lending institution. To be clear, home mortgage brokers do far more than aid you obtain an easy mortgage on your home.When you most likely to the bank, the bank can only provide you the product or services it has available. A financial institution isn't most likely to tell you to decrease the street to its competitor who supplies a home mortgage product better fit to your needs. Unlike a financial institution, a mortgage broker typically has partnerships with (often some loan providers that do not straight deal with the public), making his chances that far better of locating a lender with the best home mortgage for you.

If you're wanting to refinance, accessibility equity, or obtain a bank loan, they will certainly require details about your existing finances currently in location. When your home mortgage broker has a great idea about what you're trying to find, he can focus in on the. In most cases, your home loan broker may have practically everything he needs to continue with a home mortgage application now.

The Basic Principles Of Mortgage Broker Job Description

If you've currently made an offer on a home and it's been approved, your broker will certainly submit your application as a real-time offer. Once the broker has a mortgage dedication back from the lender, he'll look at any problems that require to be met (an assessment, proof of earnings, proof of deposit, etc).As soon as all the lender problems have actually been met, your broker ought to guarantee legal directions are sent out to your lawyer. Your mortgage broker in french broker must proceed to check in on you throughout the procedure to ensure whatever goes efficiently. This, in short, is how a home loan application functions. Why make use of a home loan broker You might be wondering why you ought to utilize a home mortgage broker.

Your broker must be well-versed in the mortgage products of all these lending institutions. This suggests you're extra likely to find the finest home loan product that suits your needs. If you're a private with damaged credit score or you're buying a property that's in less than stellar condition, this is where a broker can be worth their king's ransom.

Getting The Broker Mortgage Near Me To Work

When you go shopping on your own for a home mortgage, you'll require to make an application for a home mortgage at each loan provider. A broker, on the various other hand, should understand the lenders like the back of their hand as well as must have the ability to refine in on the lender that's finest for you, conserving you time and also protecting your credit history from being reduced by using at also several lenders.Make certain to ask your broker the number published here of lending institutions he deals with, as some brokers have accessibility to even more lending institutions than others and also might do a greater quantity of company than others, which implies you'll likely get a much better price. This was a summary of working with a mortgage broker.

85%Advertised Rate (p. a.)2. 21%Contrast Price (p. a.) Base standards of: a $400,000 lending amount, variable, fixed, principal as well as interest (P&I) mortgage with an LVR (loan-to-value) ratio of at least 80%. The 'Contrast House Loans' table allows for calculations to made on variables as picked and input by the user.

The Only Guide for Mortgage Broker

The choice to using a home loan broker is for people to do it themselves, which is occasionally described as going 'direct'. A 2018 ASIC study of customers look at more info that had obtained a lending in the previous one year reported that 56% went direct with a loan provider while 44% underwent a mortgage broker.Report this wiki page